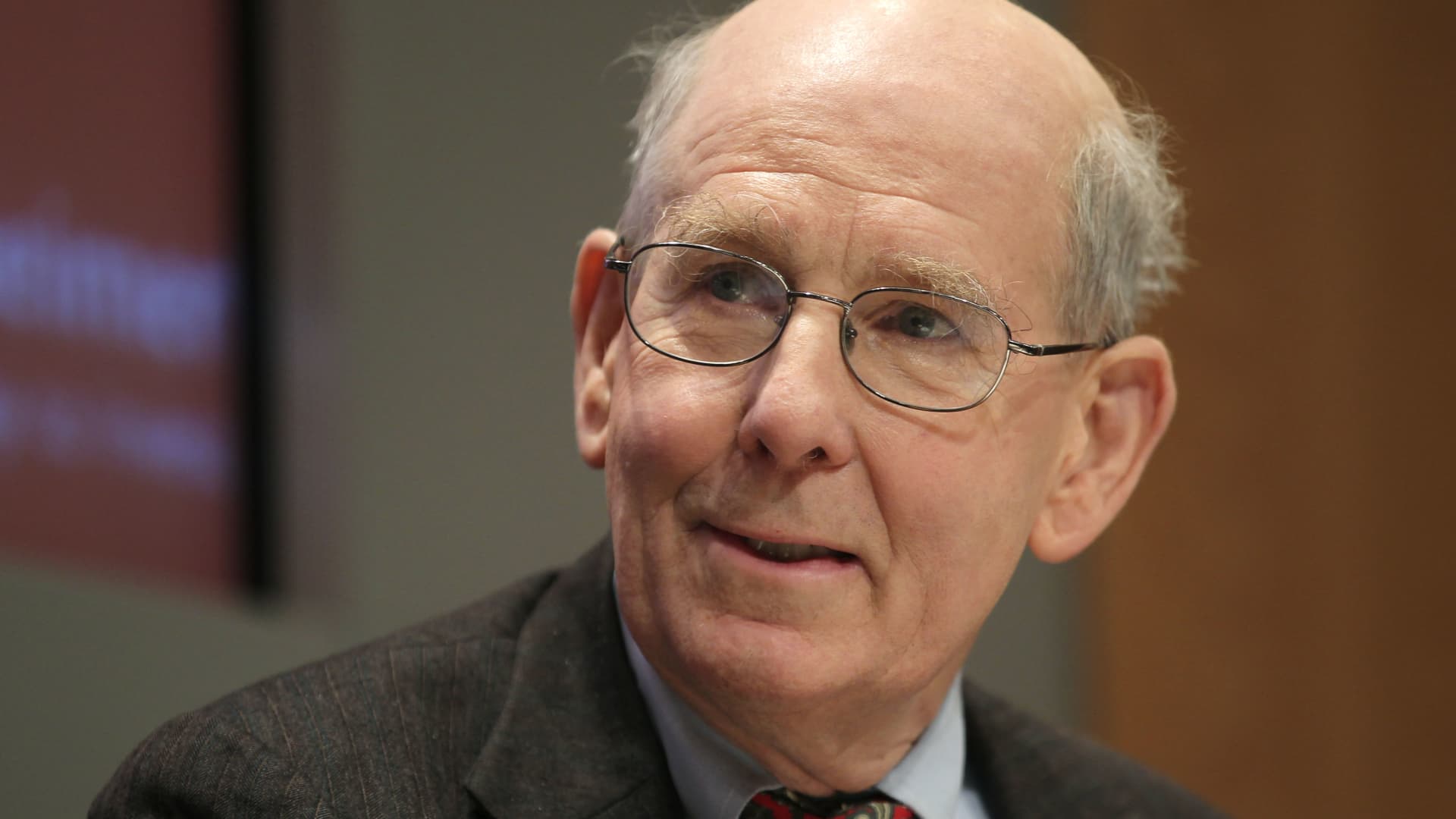

The Fed will cut rates before the ECB, former BoE DeAnne Julius said

The Federal Reserve Building stands in Washington. Joshua Roberts | Reuters The U.S. Federal Reserve is likely to cut interest rates before the European Central Bank does, a former member of the Bank of England said, defying current market expectations. “I suspect that the Fed will be the first to really put a cut in,” … Read more