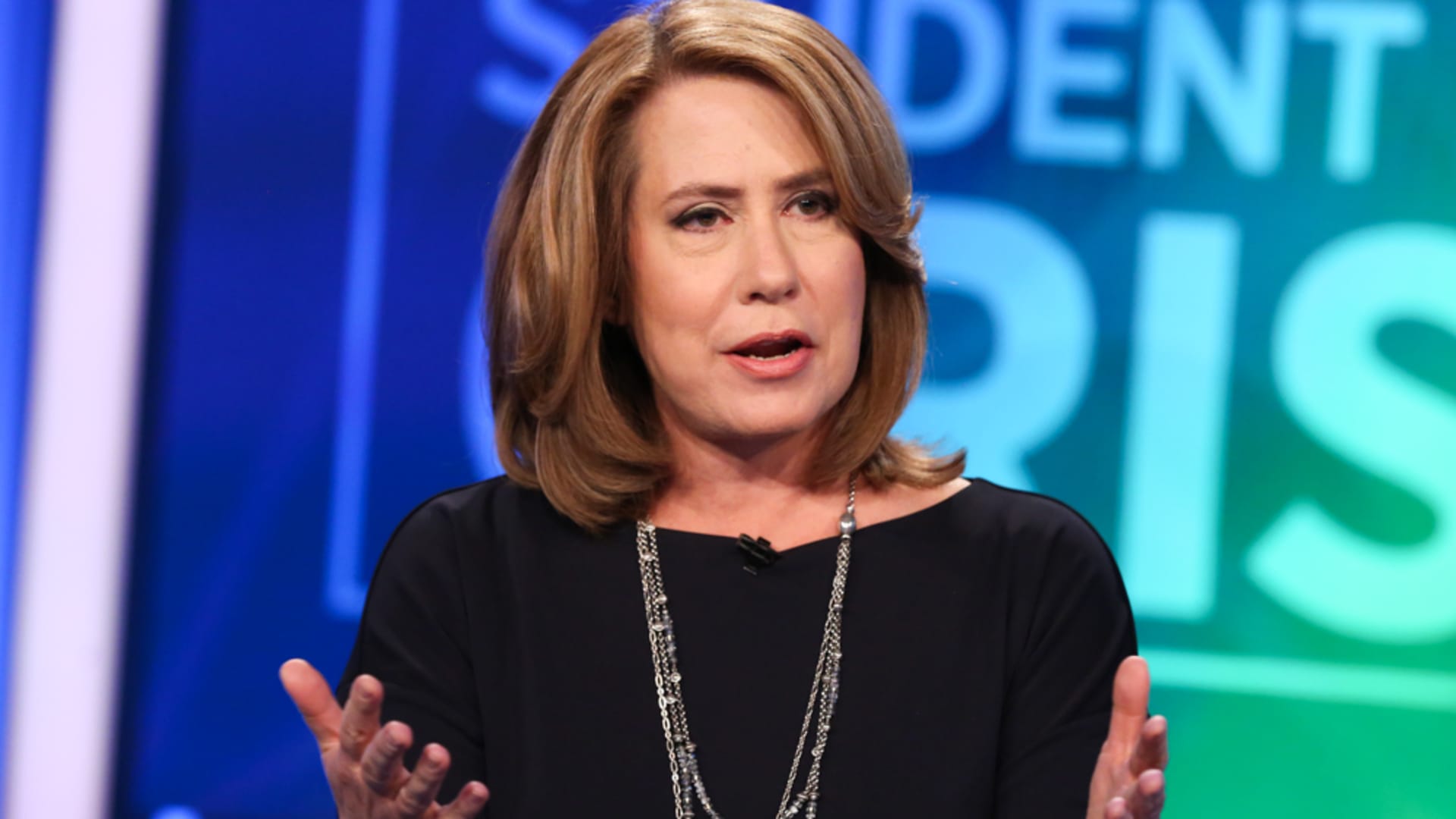

Regional bank failures may be ahead, Fmr. FDIC Chair Sheila Bair warns

Regional bank earnings may expose critical weaknesses, according to Sheila Bair, former chair of the U.S. Federal Deposit Insurance Corp. Their quarterly numbers begin hitting Wall Street this week. “I’m worried about a handful of them,” Bair told CNBC’s “Fast Money” on Tuesday. “I think some of them are still overly reliant on industry deposits, … Read more